Reduced roth ira contribution calculator

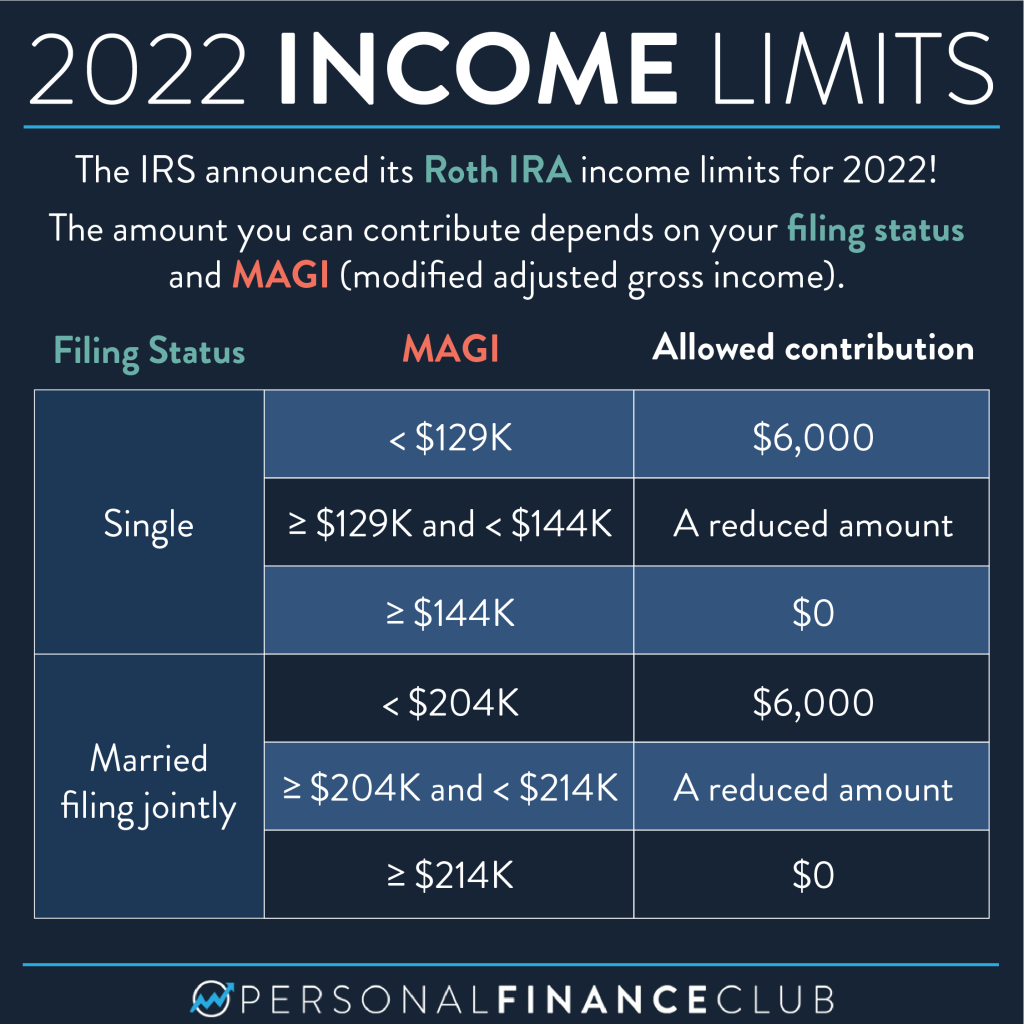

This calculator assumes that you make your contribution at the beginning of each year. Roth IRA Income Limits 2022.

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Annual IRA Contribution Limit.

. Roth IRA Reduced Contribution Calculator. Discover Fidelitys Range of IRA Investment Options Exceptional Service. You can contribute to a Roth IRA if your Adjusted Gross Income is.

Assuming youre not about to retire following year you want development as well as concentrated investments for your Roth IRA. Titans Roth IRA calculator gives anyone the ability to project potential returns from a Roth IRA retirement account based on your current age how much you plan to contribute each year the. Here the top place for financial education Im going to review three of the best Roth IRA investments.

Roth Ira Reduced Contribution Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. Our free Roth IRA calculator can calculate your maximum annual contribution and estimate how much youll have in your Roth IRA at retirement. Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance.

Traditional and Roth IRAs give you options for managing taxes on your retirement investments. Reviews Trusted by Over 45000000. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Sheena subtracts 3335 from 5000 to determine her. Also because there are no taxes owed on Roth IRA contributions setting aside as much as possible in a Roth IRA can help reduce the size of a taxable estate leaving more money for.

Amount of your reduced Roth IRA contribution. The amount you will contribute to your Roth IRA each year. Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need.

This is your reduced contribution limit. Reduced Roth IRA Contribution Limit Calculator. A Roth IRA is entirely pointless if you dont invest the cash in your Roth IRA.

For 2022 the maximum annual IRA. Many factors can affect your eligibility and contribution limits to either the Traditional IRA or Roth IRA tax filing status your current earned income level and whether or not you participate in a. Less than 140000 single filer Less than 208000 joint filer Less than.

Compare 2022s Best Gold IRAs from Top Providers. Start with your modified. Keep Your Retirement On Track.

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. For comparison purposes Roth IRA and regular taxable. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

So assuming youre not ready to retire next year you desire growth and also focused investments for your Roth IRA. For 2022 the Roth IRA income limits for a full IRA contribution is 125000 for singles and heads of household 204000 for married couples. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

To put it simply you want. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

Subtract your reduction amount from your maximum contribution amount for your age. Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022. Contributions are made with after-tax dollars.

Open A Roth IRA Today. We Go Further Today To Help You Retire Tomorrow. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Ad Learn About 2021 IRA Contribution Limits. Unlike taxable investment accounts you cant put an. 9 rows Divide the result in 2 by 15000 10000 if filing a joint return qualifying widow er or married filing a separate return and you lived with your spouse at any time during.

Ad Learn About Tax Advantages And Contribution Limits. Eligible individuals age 50 or older within a particular tax year can make an. If the amount you can contribute must be reduced figure your reduced contribution limit as follows.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Roth Ira Contribution

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Factors To Consider When Contemplating A Backdoor Roth Ira

Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Contribution Limits Medicare Life Health 2019 2020 Rules Roth Ira Roth Ira Contributions Ira

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Historical Roth Ira Contribution Limits Since The Beginning

2019 Ira 401k And Roth Ira Contribution Limits Roth Ira Eligibility Ira Tax Deductions And More Begin To Invest

Understanding The Mega Backdoor Roth Ira Roth Ira Roth Ira Conversion Ira

Is It Worth Doing A Backdoor Roth Ira Pros And Cons

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Contributing To Your Ira Start Early Know Your Limits Fidelity